Together with the technology progress in digital employee management software, a number of businesses have migrated to pay-stub-generator.com rather than mailing or handing out paper pay-stub-generator.com. They could email pay-stub-generator.com notification to every worker or possess a secure log on setup for every employee to register and see their pay-stub-generator.com in their own time.

The digital capabilities benefit employees and companies for lots of factors. Firms save money on newspaper and mailing costs, the applications flow lines payroll, benefits, and reimbursement procedures reducing a chance of malfunction, and it keeps data concentrated for effortless editing or research. On the flip side, it lowers the total amount of paperwork and mail which workers get, it provides the ability to access their pay check at any internet place, and it makes exploring or collecting payroll information simpler.

Since digital employee management applications have made it a lot easier to obtain and see pay-stub-generator.com, it provides us more reason to make sure we know what we're looking at. Important fiscal, tax, and gain information we must all pay attention to is recorded.

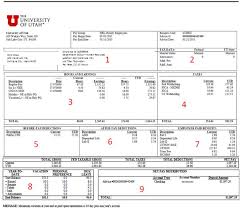

pay-stub-generator.com designs differ from company to company but they'll all include the following...

Personal Information - This includes the business name, employee name, address, and also maybe the worker social security number.

Important Dates - Dates listed will incorporate the pay period start and finish date, and the date of the test or pay-stub-generator.com issuance. Some sections also have a Year-to-date column to demonstrate just how much you had been paid, how much was withheld, or just how much was deducted thus far that year.

Taxable Earnings - This is the total amount of income that's earned for the particular pay period.

Web Pay - This is the sum of income received for "take home" following all essential withholdings. This will match the sum of your physical paycheck or direct deposit cover.

Federal Tax - This is an income tax exempt which each and every employee pays. The percentage withheld is dependent upon the total amount of income you create along with the information you recorded in your W-4.

Condition Tax - The state income tax withholding isn't mandatory for everybody. It depends on what state you reside in and their taxation laws. Additionally, it is a percentage based on what you create.

Social Security - This is the US method of supplemental retirement cash. Every employee contributes the identical proportion of the gross income. Employers provide a matching percentage also.

Medicare - This is the US government insurance program. It offers medical benefits to the retired and handicapped employees over 65 years of age. All workers and employers pay a fitting percentage of gross earnings.